-Submitted by David Drumm (Nal), Guest Blogger

With the recent appearance of Gretchen Morgenson and Joshua Rosner’s R

eckless Endangerment, the focus on the financial meltdown turns to Government Sponsored Enterprise (GSEs) such as Fannie Mae and Freddie Mac (F&F). The claim is that the role of F&F in the meltdown is being marginalized or ignored. Some

claim that this book fills an important void.

However, the role of F&F has been well researched and documented.

The GSEs, by charter, are intended to facilitate mortgage finance to lower-income homeowners. These lower-income borrowers, with no political support structure, are the perfect patsies for those looking to shift the blame for the financial crisis. Republicans have used the “affordability” aspect of the GSEs mission to blame F&F for the financial crisis. The facts just don’t bear them out.

In Raj Date’s

presentation, he notes that GSEs $100 billion of private-label subprime Mortgage Backed Securities (MBS) in their portfolio is only 2% of their $5 trillion credit exposure. He writes:

Moreover, the very worst performing GSE loans (that is, the loans where losses are the greatest multiple of original forecasts) were made to prime borrowers, not subprime.

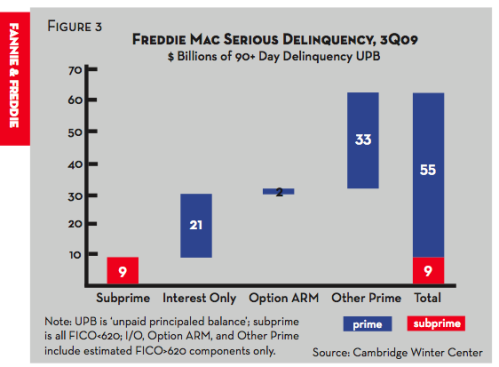

As shown in the graph below, it is the prime mortgages that make up the vast majority of serious delinquencies.

As Raj Date points out, the serious delinquencies came from “Alt-A” and “Interest Only”, which had average borrower FICO scores of 722 and 720, respectively, solidly within the “prime” category.

Between 2004 and 2006 the volume of subprime and the riskier (than conventional) Alt-A mortgages ballooned. In 2005 and 2006, conventional, conforming mortgages accounted for one-third of all mortgages originated.

From early 2004 to late 2007, it was the private-label insurers that played a large role in securitizing (pooling contractual debt into bonds) the higher-risk mortgages.

They focus blame largely on the so-called “private label” mortgage market. These are bank and non-bank, brokers, lenders, and securitizers.

If F&F had accepted their lower market share and not tried to stay competitive with the private-label insurers during the bubble, their losses would have been substantially less. The F&F blame game is a desperate attempt, not borne out by facts, to shift the focus of the financial crisis away from the private-label insurers.

With the recent appearance of Gretchen Morgenson and Joshua Rosner’s Reckless Endangerment, the focus on the financial meltdown turns to Government Sponsored Enterprise (GSEs) such as Fannie Mae and Freddie Mac (F&F). The claim is that the role of F&F in the meltdown is being marginalized or ignored. Some claim that this book fills an important void.

With the recent appearance of Gretchen Morgenson and Joshua Rosner’s Reckless Endangerment, the focus on the financial meltdown turns to Government Sponsored Enterprise (GSEs) such as Fannie Mae and Freddie Mac (F&F). The claim is that the role of F&F in the meltdown is being marginalized or ignored. Some claim that this book fills an important void.

by Matt Taibbi

January 4, 2010

http://trueslant.com/matttaibbi/2010/01/04/fannie-freddie-and-the-new-red-and-blue/

Everyone was involved in the mortgage scam. At the lender level the deceptions were myriad; liar’s loans, fraudulent income documentation, negative amortization loans, HELOCs, etc. The rush to get as many loans written as possible and then get those hot potatoes moved to the next sucker in the line was furious and extended from coast to coast, sinking one lender after another in Ponzoid debt and indictments.

11/17/2010

http://www.rollingstone.com/politics/blogs/taibblog/mortgage-bubble-blamed-ludicrously-on-the-government-20101117

The reason there was a sudden rush to lend out homes to subprime borrowers was not because of Fannie and Freddie, but because the banks had discovered fancy new derivative tools like CDOs and CMOs that allowed them to chop up bundles of home loans and turn them into AAA-rated securities. Countrywide was not trolling the streets looking for jobless indigents to lend mansions to (this literally happened, by the way) because the government was forcing them to. It was because big banks like Goldman and JP Morgan Chase and Bank of America were letting them know that they had a virtually limitless market for mortgage-backed securities, thanks to the new derivative tools that allowed them to sell billions of subprime MBS as AAA-rated investments to suckers like German land-banks and Icelandic trade unions and the like.

burns me…

house, and B.of A. thinks it is theirs!!!

2. Retirement age will rise much faster than actual longevity

3. The ability to draw social security with part-time employment will be highly constrained

4. Survivorship benefits will be cut

5. The future value of benefits will continue to decrease relative to real inflation (as opposed to official inflation)

6. Ultimately, benefits will be means-tested against Roth, IRA, 401K, 403B, and pension holdings.

I am with you. Krugman is heads above Schiff and any other right wing talking point so-called economist.

CNN

By Ben Rooney, staff reporterJanuary 27, 2011

http://money.cnn.com/2011/01/27/news/economy/fcic_crisis_avoidable/index.htm

NEW YORK (CNNMoney) — The financial crisis, which wreaked havoc on the economy and sparked a painful recession, could have been avoided, according to a federal commission.

they were all fired.

2. Oil prices 1979

3. Trucking 1980

4. Railroads 1980

5. Interest Rates 1980

By PAUL KRUGMAN

Published: May 31, 2009

http://www.nytimes.com/2009/06/01/opinion/01krugman.html

“This bill is the most important legislation for financial institutions in the last 50 years. It provides a long-term solution for troubled thrift institutions. … All in all, I think we hit the jackpot.” So declared Ronald Reagan in 1982, as he signed the Garn-St. Germain Depository Institutions Act.

By Peter Dreier

NHI, May/June 2004

http://www.nhi.org/online/issues/135/reagan.html

Reagan also presided over the dramatic deregulation of the nation’s savings and loan industry allowing S&Ls to end their reliance on home mortgages and engage in an orgy of commercial real estate speculation. The result was widespread corruption, mismanagement and the collapse of hundreds of thrift institutions that ultimately led to a taxpayer bailout that cost hundreds of billions of dollars.

By DAVID STOCKMAN

Published: July 31, 2010

http://www.nytimes.com/2010/08/01/opinion/01stockman.html?ref=opinion

The second unhappy change in the American economy has been the extraordinary growth of our public debt. In 1970 it was just 40 percent of gross domestic product, or about $425 billion. When it reaches $18 trillion, it will be 40 times greater than in 1970. This debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party’s embrace, about three decades ago, of the insidious doctrine that deficits don’t matter if they result from tax cuts.

by Robert E. Prasch

Common Dreams

May 7, 2011

http://www.commondreams.org/view/2011/05/07-7

Note: Robert E. Prasch is Professor of Economics at Middlebury College where he teaches courses on Monetary Theory and Policy, Macroeconomics, American Economic History, and the History of Economic Thought. His latest book is How Markets Work: Supply, Demand and the ‘Real World’ (Edward Elgar, 2008).

1, June 7, 2011 at 6:25 pm

So I guess what you are both saying is that since markets are nothing but an aggregate of individuals, you are against individuals?

1, June 7, 2011 at 9:04 pm

government workers are not saints, a good many of them have no fealty to the US or the Constitution. They just want to grow their fiefdom so they can perpetuate their own agendas and insure their GS15 designation and the pay and percs which accompany that level of government service.

but

the average federal worker is not a GS15 nor do they have a “fiefdom”.