Thank you, Deontos!

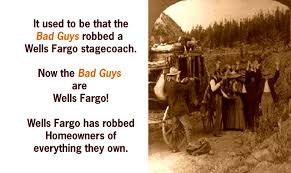

Wells Fargo DOES steal homes, I've been saying it since 2007 when they stole mine out from under me. Wells Fargo creates problems on your mortgage account (a negative escrow in my case, pays property taxes that have already been paid (in my case) incorrectly applies payments, failure to apply payments (in my case), on and on, so their foreclosure actions will appear justified to the OCC and the CFPB.

Kelly L. Hansen (ctsmyhon@yahoo.com)

Wells Fargo DOES steal homes, I've been saying it since 2007 when they stole mine out from under me. Wells Fargo creates problems on your mortgage account (a negative escrow in my case, pays property taxes that have already been paid (in my case) incorrectly applies payments, failure to apply payments (in my case), on and on, so their foreclosure actions will appear justified to the OCC and the CFPB.

Kelly L. Hansen (ctsmyhon@yahoo.com)

The government program that failed homeowners

Owners are finding government help hard to find against foreclosure. Photograph: Tracey Whitefoot/Alamy

Chris Cooley never missed a payment on his mortgage in Long Beach, California. Every month, Wells Fargo would debit him $3,100 for the four-unit building; one of the units was his, and the other three he rented out for income to cover the mortgage. In 2009, when the housing crisis hit, Cooley needed a way to reduce his mortgage. He renegotiated his loan through the Home Affordable Modification Program, known as Hamp. Initially, it was a success: his mortgage payments fell in half, to $1,560.A Wells Fargo branch in Colorado. Photograph: Rick Wilking/Reuters

So it was surprising when a ReMax agent, sent on behalf of Wells Fargo, knocked on the door in December 2009 and told Cooley the building no longer belonged to him. The bank planned to take the building he had lived in and rented out for a decade – and list the property for sale.So much for government help.But it turned out that Cooley was not getting government help; without his knowledge, Wells Fargo had put him on what was only a trial Hamp payment program. He had been rejected for a permanent mortgage modification – only Wells Fargo never informed him about the rejection, he says, nor did they give him a reason why.What followed was what most homeowners would consider a nightmare. While Cooley tried to stave off foreclosure to save his home and livelihood, Wells Fargo paid the other renters living in the property $5,000 to move out behind his back, and then denied Cooley further aid – because his income, which he drew from the rentals, was too low. "They took my income away from me, and then they couldn't give me a loan because I had no income," Cooley said. "What a wonderful catch-22."The bank held his final trial payment in a trust and never applied it to his loan (to this day, Cooley has never received that money back). For two years, Cooley appealed to Wells Fargo for some alternative form of relief, sending in paperwork time and again, talking to different customer service representatives who knew nothing about his situation, and generally running in place without success.Tired of fighting, Cooley ended up leaving his home, and became just one of the seven million foreclosure victims in the US since the bursting of the housing bubble in 2007."Wells Fargo stole my home, plain and simple," he said.

MORE

--

--

And how many times can a man turn his head,and pretend that he just doesn't see?And how many ears must one man have,before he can hear people cry ?And how many deaths will it take till we know,that too many people have died?The answer my friend is blowing in the wind,the answer is blowing in the wind.

No comments:

Post a Comment